Turn a 90-day grind into a 30–45-day win with disciplined prep and tight coordination.

Executive Summary

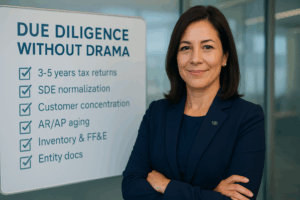

Due diligence doesn’t kill deals—poor preparation does. The fix is a prioritized, time-boxed process led by a single coordinator, a lender-ready data room, and a checklist that focuses on material issues (value, risk, and ability to transfer/operate). Use the playbook below to stay thorough and fast.

The Master Checklist (Prioritized for Speed)

-

Financial Essentials (Deal-Breakers First)

-

3–5 years tax returns and year-end financials; current YTD P&L & balance sheet (monthly, if possible)

-

SDE normalization: owner comp, perks, one-time/non-recurring items, related-party charges

-

Customer concentration (top 10 by revenue, trends, churn) and seasonality analysis

-

AR/AP aging; all debt/notes with terms, liens/UCCs

-

Inventory & FF&E schedules (condition, turns, obsolescence, maintenance logs)

-

Operational Must-Haves

-

Org chart, key employee roles/tenure/comp/agreements; retention risks

-

Major customer/vendor contracts (assignability, pricing, termination rights)

-

SOPs, workflow, service standards, capacity constraints, and backlogs

-

Tech stack (licenses, custom tools, data ownership)

-

Insurance (GL, Auto, WC, cyber); claims history and gaps

-

Facilities & fleet: leases, titles, service records, compliance

-

Legal & Compliance

-

Entity docs (good standing), cap table/ownership confirmations

-

All contracts > $10k/yr and any exclusivity, MFN, or change-of-control clauses

-

Permits & licenses; industry-specific regulatory requirements

-

Pending/previous litigation; settlements, regulatory actions, liens

-

Strategic Fit

-

Competitive position, pricing power, moat (relationships, routes, IP, location)

-

Key-person dependencies; transition/knowledge capture plan

-

Growth levers (cross-sell, pricing, territory, capacity) vs. blockers (labor, equipment, working capital)

-

Risk register with mitigations (escrow, reps & warranties, price adjustments, covenants)

A 6-Week, No-Drama Timeline

Week 1: Kickoff & Lender-Ready Data Room — Coordinator assigned, request list sent, seller upload SLA set; import historicals; start SDE model.

Week 2: Financial Triage — Close gaps in financial pack; verify tax ↔ books; run concentration/seasonality; identify deal-breakers.

Week 3: Ops & People — SOPs, contracts, scheduling, capacity, fleet/facilities; key-staff interviews (as appropriate).

Week 4: Legal & Compliance — Entity, contracts, leases, licenses, liens/UCCs; flag change-of-control, assignability, and consents.

Week 5: Synthesis & Negotiation Levers — Findings memo: value impacts, covenants, escrows, price/structure recommendations.

Week 6: Close Readiness — Finalize schedules/exhibits, confirm lender conditions, draft transition plan & first-90-day operating checklist.

Red Flags That Stop the Clock

-

Books and tax returns don’t reconcile; unexplained margins

-

Undisclosed customer loss or a top account at risk

-

Unassignable key contracts or non-transferrable licenses

-

Key employee intends to exit with no backfill plan

-

Regulatory exposures (safety, environmental, licensing) with penalties

-

Hidden debt/UCCs, liens, or off-balance-sheet obligations

Mistakes That Kill Momentum -

Analysis paralysis: debating immaterial variances while significant risks linger

-

Scope creep without resetting deadlines

-

Decentralized advisors: CPA, attorney, lender working in silos

-

Poor communication: seller left guessing; lender missing artifacts

How VR Atlanta Keeps It Calm and Closed

-

-

Single-threaded coordination: one owner for timeline, requests, and status

-

Lender-ready packaging: clean SDE, comps, and a structured data room that answers underwriting before it’s asked

-

Issue framing, not firefighting: findings memo with clear options (price, terms, escrows, reps/warranties)

-

Confidentiality by design: controlled disclosure, staged access, and NDAs that match the process

-

Local know-how + national reach: Atlanta market expertise backed by the VR network’s playbooks and buyer pool

-

FAQs (Quick Takes)

Q: What does diligence usually cost?

A: Roughly 1–3% of EV across advisors; targeted scopes and a clean data room keep costs in check.

Q: What if we uncover major issues?

A: Use price adjustments, escrows, seller notes, or reps & warranties—walk only for unfixable value/transfer risks.

Q: Can we go faster in a competitive process?

A: Yes—front-load financials, run parallel tracks, and keep a lender in the loop from Day 1. Thirty days is achievable with a prepared seller.

Q: Should we use the seller’s advisors?

A: No. Keep advisors independent to avoid conflicts.

Bottom Line

Efficient diligence involves a checklist, cadence, and coordination. Do the material work first, communicate relentlessly, and keep every artifact lender-ready. That’s how you trade drama for discipline—and close on time.

Want to learn more….