Summary:

Many business owners misunderstand how valuation multiples work—and end up overestimating what their business is worth. This blog explains what SDE multiples truly reflect, why they vary by industry and deal size, and how buyers (and lenders) use them to make decisions. Knowing your true multiple range is the first step to a real exit strategy—not just a wish.

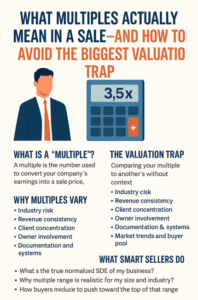

What Multiples Actually Mean in a Sale—And How to Avoid the Biggest Valuation Trap

If you’ve ever heard someone say, “My business is worth 4x,” stop right there. Four times what, exactly? And who’s doing the multiplying?

In Georgia, I meet business owners every week who anchor their valuation to hearsay—usually from someone who hasn’t actually sold a business. That’s dangerous. Here’s what you need to know.

What Is a “Multiple”?

A multiple is the number used to convert your company’s earnings into a sale price. Most small and lower middle market deals are based on SDE (Seller’s Discretionary Earnings)—not net income or EBITDA.

So when we say a business sold for “3.2x,” that means 3.2 times the normalized earnings available to the owner-operator.

Why Multiples Vary

Multiples depend on many things:

-

Industry risk (landscaping vs. SaaS = big difference)

-

Revenue consistency

-

Client concentration

-

Owner involvement

-

Documentation and systems

-

Market trends and buyer pool

Two companies with the same SDE can have totally different valuations. One gets 2.5x. Another gets 4.0x. Why? One’s prepared. One’s not.

The Valuation Trap

The biggest trap? Comparing your multiple to someone else’s with no context.

Let’s say your buddy sold his HVAC business for 4x. Great. But maybe:

-

He had $10M revenue and $2M EBITDA

-

He had a management team

-

The buyer was private equity

-

He owned the building

That’s not your business. And that’s not your multiple.

What Smart Sellers Do

Smart sellers ask:

-

What is the true normalized SDE of my business?

-

What multiple range is realistic for my size and industry?

-

What risks do I need to reduce to push toward the top of that range?

Then they prepare accordingly—with help.

Q&A

Q: What is a fair multiple to sell a business in Georgia?

A: Most businesses in Georgia under $5M in revenue sell between 2.0x–3.5x SDE, depending on quality.

Q: Can I increase my multiple?

A: Yes. Reduce owner dependency, improve margins, and have 3 years of clean financials.

Q: What do buyers look at when choosing a multiple?

A: Risk, repeatability, documentation, industry, and growth trajectory.

We’ve worked with business owners across Sandy Springs, Alpharetta, and metro Atlanta who wanted to sell but had the wrong expectations. Once we adjusted the multiple to reflect reality, we got real offers.